What Impact Does a Recession Have on Property Values?

The word Recession has been thrown around for the last few months and there is talk on how it will impact the housing market. So, the first question to ask is, what is a recession?

A Recession is a significant decline in economic activity spread across the economy lasting more than a few months, normally visible in real GDP (Gross Domestic Product), real income, employment, industrial production and whole-sale retail sales.

The "R" word always sounds scary and negative!

So how does a Recession impact Real Estate values and those looking to buy or sell? Here are what 2 top industry leaders tell us. Danielle Hale, Chief economist tells us,

“The housing market is at a turning point. We are starting to see signs of a new direction, but the ball is still in the seller’s courts in most housing markets.”

Mortgage Expert, Shivani Peterson, says,

“If you are looking to buy a home, I would still recommend you do so even at the higher interest rates because we have no reason to believe that home prices will stop appreciating. Home values going up is only a problem when you're trying to buy. When you own, it's a gift.”

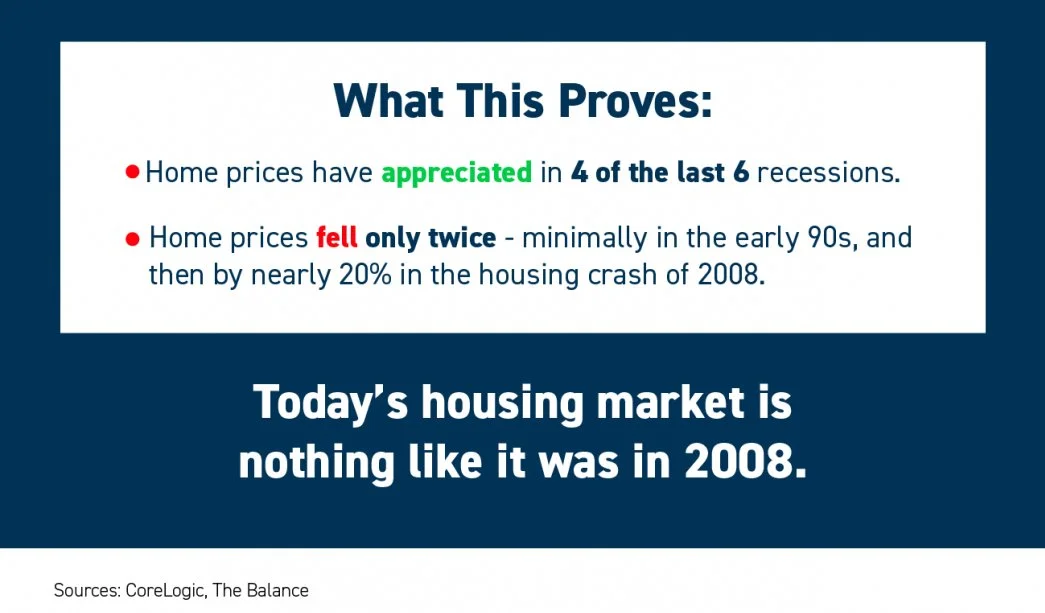

As the graph below shows us, we have had 6 recessions going back to the early 80's and only 2 of them have directly affected the Real Estate Market with the Recession of '91 affecting home prices by less than 2%.

On a recent call with Realtor.com,

“…experts don’t believe the market is in a crash or a bubble is in the cards. The nation is still suffering from a housing shortage that has reached crisis proportions at a time when many millennials are reaching the age when they start to consider home ownership. That’s likely to keep prices high."

As has long been known, Owning real estate is the best hedge against inflation. If it makes sense financially, and you can make it work in your budget, it's always a good time to purchase.